Mattor

-20%

Finns i: Metervara

25 kr

Från

20 kr

Finns i: 135x195, 160x230, 60x110, 75x180, 75x240

Från

139 kr

Finns i: 135x195, 160x230, 60x110, 75x180, 75x240

Från

139 kr

Finns i: 135x195, 160x230, 60x110, 75x180, 75x240

Från 139 kr

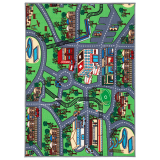

Finns i: 135x195, 160x230, 60x110, 75x150, 75x220

Från 169 kr

-20%

Finns i: 45x75

269 kr

215 kr

Finns i: Ø120, Ø160, Ø200, Ø240, Ø80

Från 149 kr

Finns i: 133x190, 160x230, 200x290, 57x150, 57x220, 80x150, 80x250,...

Från 169 kr

-10%

Finns i: 133x170

319 kr

287 kr

Finns i: 70x160, 70x250

Från 269 kr

-20%

Finns i: 60x90, 85x130

429 kr

Från

343 kr

Finns i: Ø120, Ø160, Ø200, Ø240, Ø80

Från 149 kr

-10%

Finns i: 120x170, 140x200, 160x230, 200x290, 240x340, 60x120, 80x160

249 kr

Från 224 kr

Finns i: Ø120, Ø160, Ø200, Ø240, Ø80

Från 149 kr

Finns i: 75x150, 75x200

Från 299 kr

-10%

Finns i: 133x190, 160x230, 200x290, 80x250, 80x350

409 kr

Från 368 kr

-15%

Finns i: Ø200, Ø60

259 kr

Från 220 kr

-15%

Finns i: 60x90

449 kr

382 kr

-10%

Finns i: 60x90

449 kr

404 kr

-10%

Finns i: 200x70, 300x200, 50x80

279 kr

Från 251 kr

Finns i: 200x70, 300x200, 50x80

Från 279 kr

Finns i: 70x160, 70x250

Från 269 kr

Finns i: 140x200, 160x230, 200x290, 240x340, 60x110, 80x150, 80x230

Från 169 kr

Finns i: 160x230, 295x395

Från 1 559 kr

Fraktfritt!

Finns i: Ø120, Ø160, Ø200, Ø240, Ø80

Från 149 kr

-20%

Finns i: 90x110

549 kr

Från 439 kr

-15%

Finns i: Ø200

2 589 kr

2 201 kr

Fraktfritt!

-10%

Finns i: Ø200

1 739 kr

1 565 kr

Fraktfritt!

-15%

Finns i: 160x230, 200x290, 295x395

1 589 kr

Från 1 351 kr

Fraktfritt!

-10%

Finns i: 160x230, 200x290, 295x395

1 589 kr

Från 1 430 kr

Fraktfritt!

Finns i: 160x230, 200x300, 300x400

Från 3 229 kr

Fraktfritt!

-10%

Finns i: 140x200, 200x300, 60x90, 70x200

221 kr

Från 199 kr

-10%

Finns i: 180x230, 225x300, 300x400, 70x200

889 kr

Från 800 kr

Fraktfritt!

-5.%

Finns i: 160x230, 200x290, 80x150, 80x250, 80x350

259 kr

Från 246 kr

Finns i: 160x230, 200x290, 80x150, 80x300

Från 549 kr

Finns i: Ø120, Ø160, Ø200, Ø240, Ø80

Från 149 kr

Finns i: 120x170, 160x230, 200x300, 240x330, 300x400, 50x80, 67x120,...

Från 389 kr

Finns i: 135x195, 160x230, 200x300, 60x110, 75x150, 75x230

Från 269 kr

Finns i: 110x160, 133x190, 60x120, 80x160

Från 262 kr

Finns i: 130x190, 240x330, 80x250, 80x350

Från 399 kr

Finns i: 160x230, 200x300, 240x330, 80x150, 80x250, 80x350

Från 329 kr

-10%

Finns i: 70x160, 70x250

220 kr

Från 198 kr

Finns i: Ø120, Ø160, Ø200, Ø80

Från

249 kr

-20%

Finns i: 133x190, 160x230, 200x285, 80x150, 80x240, 80x340

319 kr

Från 255 kr

Finns i: 130x190, 160x230, 200x300, 80x150, 80x250

Från 329 kr

Finns i: 60x90, 70x120, 80x150

Från 499 kr

-20%

Finns i: 60x90, 70x200

209 kr

Från 167 kr

Finns i: 135x195, 160x230, 60x110, 75x150, 75x220

Från 169 kr

-20%

Finns i: 170x240, 200x300

625 kr

Från 500 kr

Finns i: 133x190, 160x230, 200x285, 50x80, 80x150, 80x240, 80x340

Från 129 kr

Finns i: Metervara

Från

49 kr

Finns i: 45x75

99 kr

Resultat 1 - 60 av 966

Ripsmattor i olika färger och mönster.. Här hittar du även dörrmatta gummi, jutematta, ullmatta, mattor från Boel & Jan, Dixie och Svanefors. Samt olika storlekar som 200x300, 40cm bred, 50x150, 50x80, 60cm bred, 60x90, 60x120, 60x200, 80x300, 80x150 och ullmatta 200x300 samt Svanefors matta 200x300. Freizematta är en matta kort lugg. Matta lång lugg t.ex. Heaven.